Take Control of Your Financial Future

Your credit report is more than just numbers—it tells a story about your financial health. A well-maintained credit report can help you qualify for loans, secure better interest rates, and improve your overall financial well-being.

With Splendi, checking your credit report is easy, secure, and free. Follow our step-by-step guide to register, verify your identity, and gain access to your full credit report in just a few minutes.

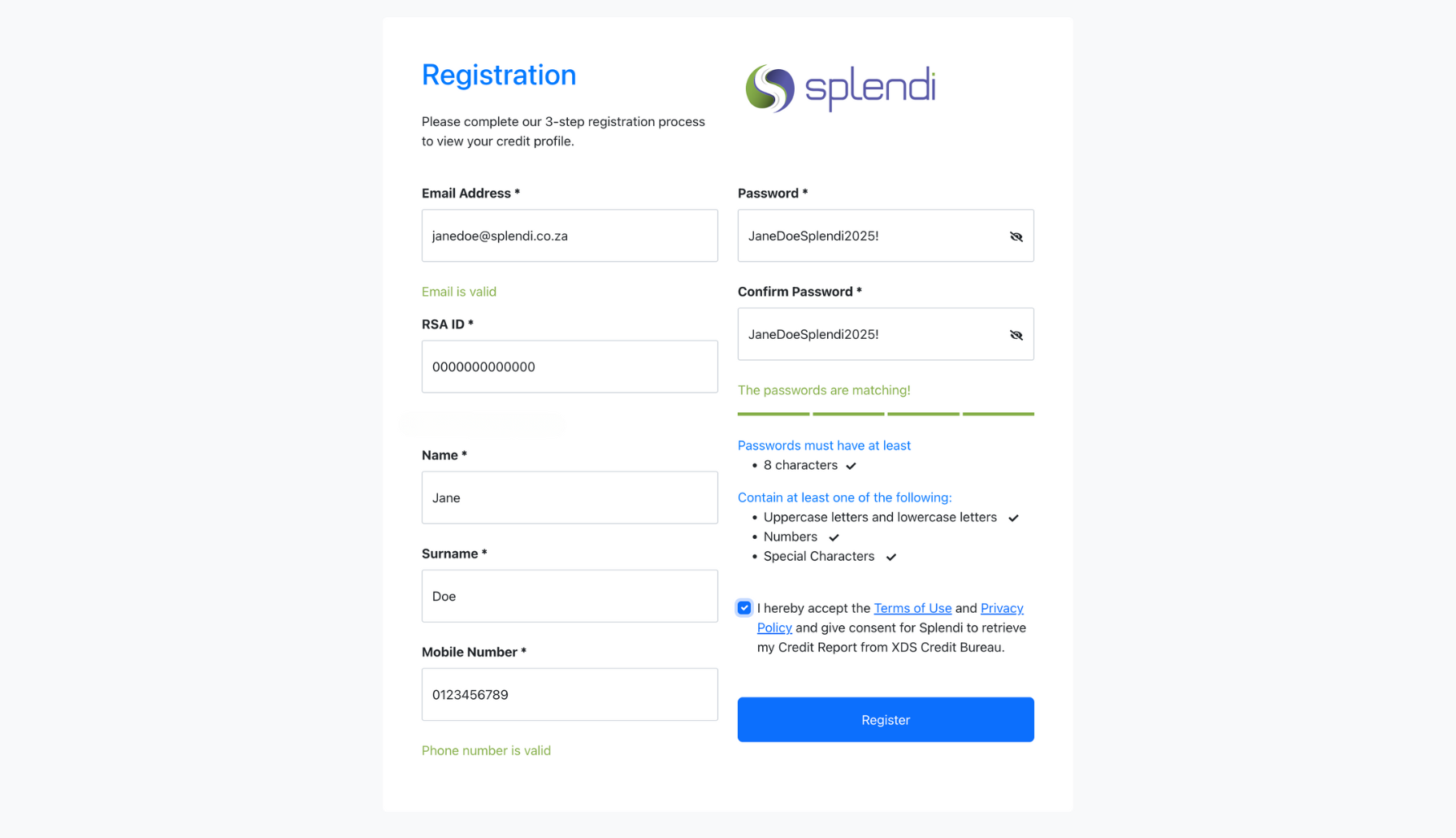

Step 1: Register on Splendi

The journey to financial empowerment begins with a simple sign-up process.

- Visit www.splendi.co.za.

- Click ‘Register’ and enter your details, including your mobile number.

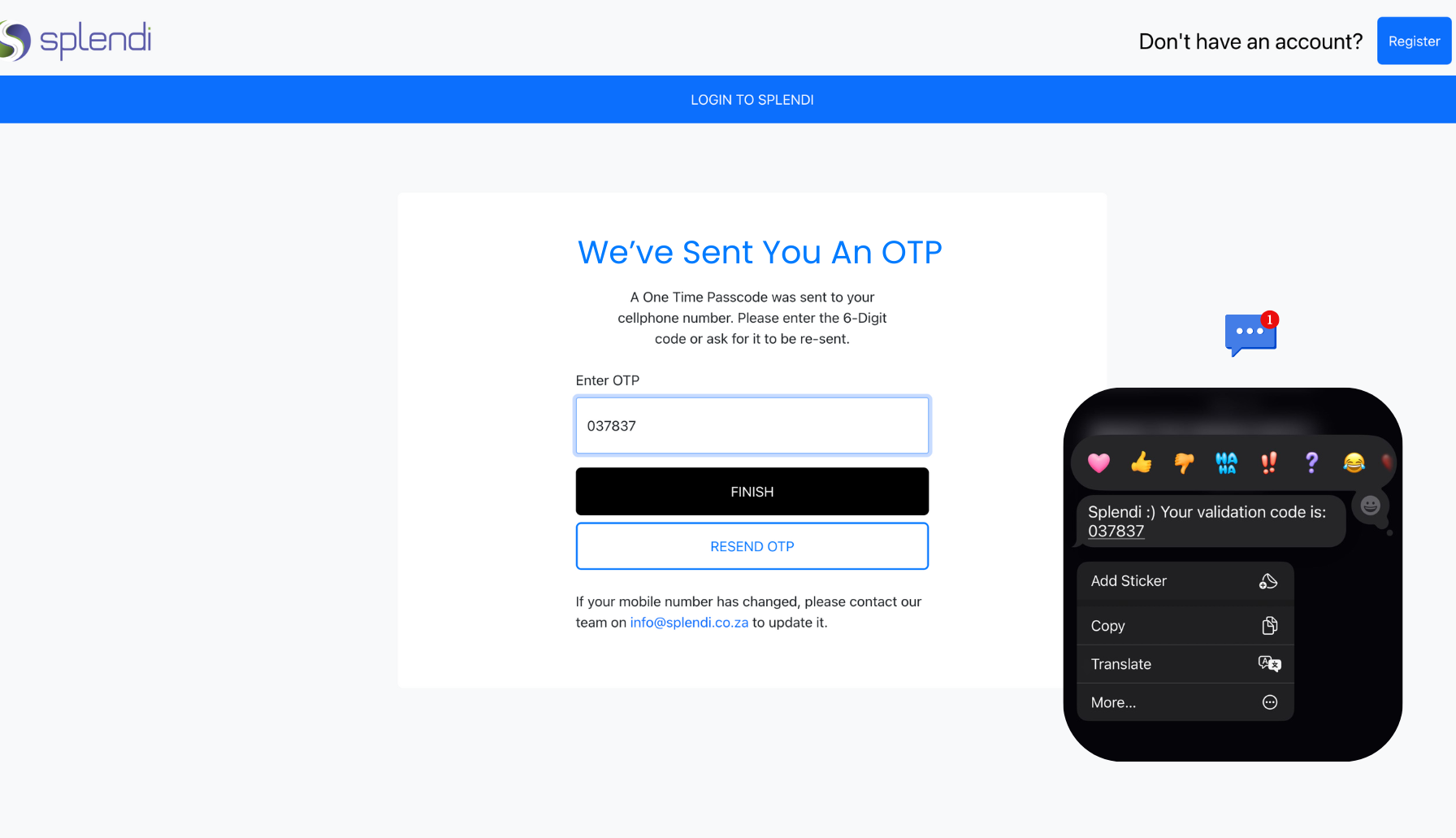

Step 2: Receive and Enter Your OTP

Security is key! Splendi uses a One-Time Password (OTP) to verify your identity.

- You will receive an SMS with a unique OTP.

- Enter this code on the registration page to proceed.

📌 What is an OTP?

An OTP is a temporary, unique security code that ensures only you can access your account.

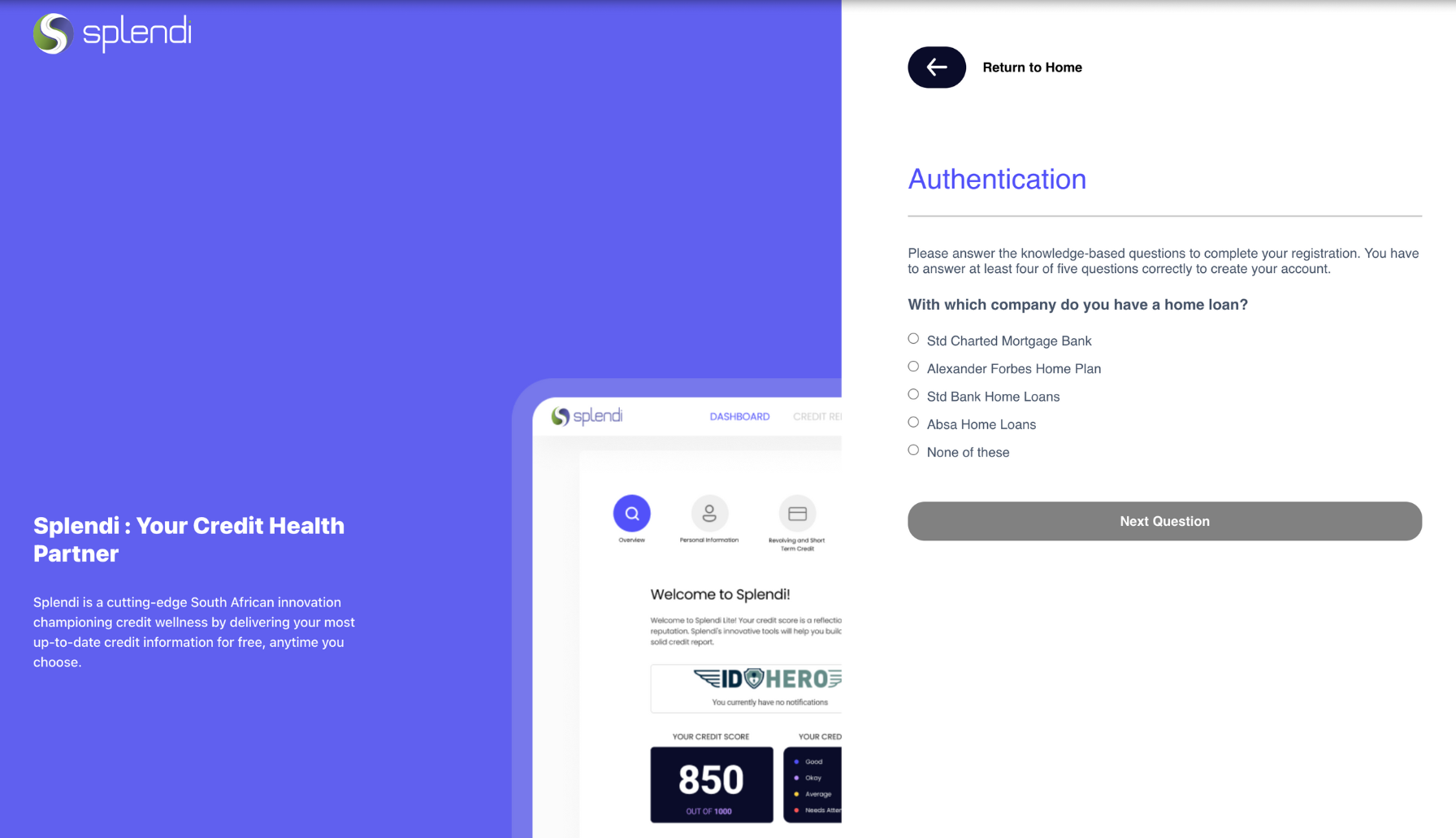

Step 3: Answer KBA Questions

To add another layer of security, Splendi uses Knowledge-Based Authentication (KBA) questions.

- You will be asked five personal questions related to your credit and financial history.

- Answer them correctly to verify your identity.

- If a question does not relate to you, simply click ‘None of the above’.

📌 What are KBA questions?

These questions confirm that the person accessing the credit report is the real account holder.

Step 4: Access Your Dashboard

If you pass the KBA questions, you’ll land on your Splendi Dashboard, your dashboard provides a glimpse into your credit profile.

- Here, you’ll see an overview of your credit status and financial standing.

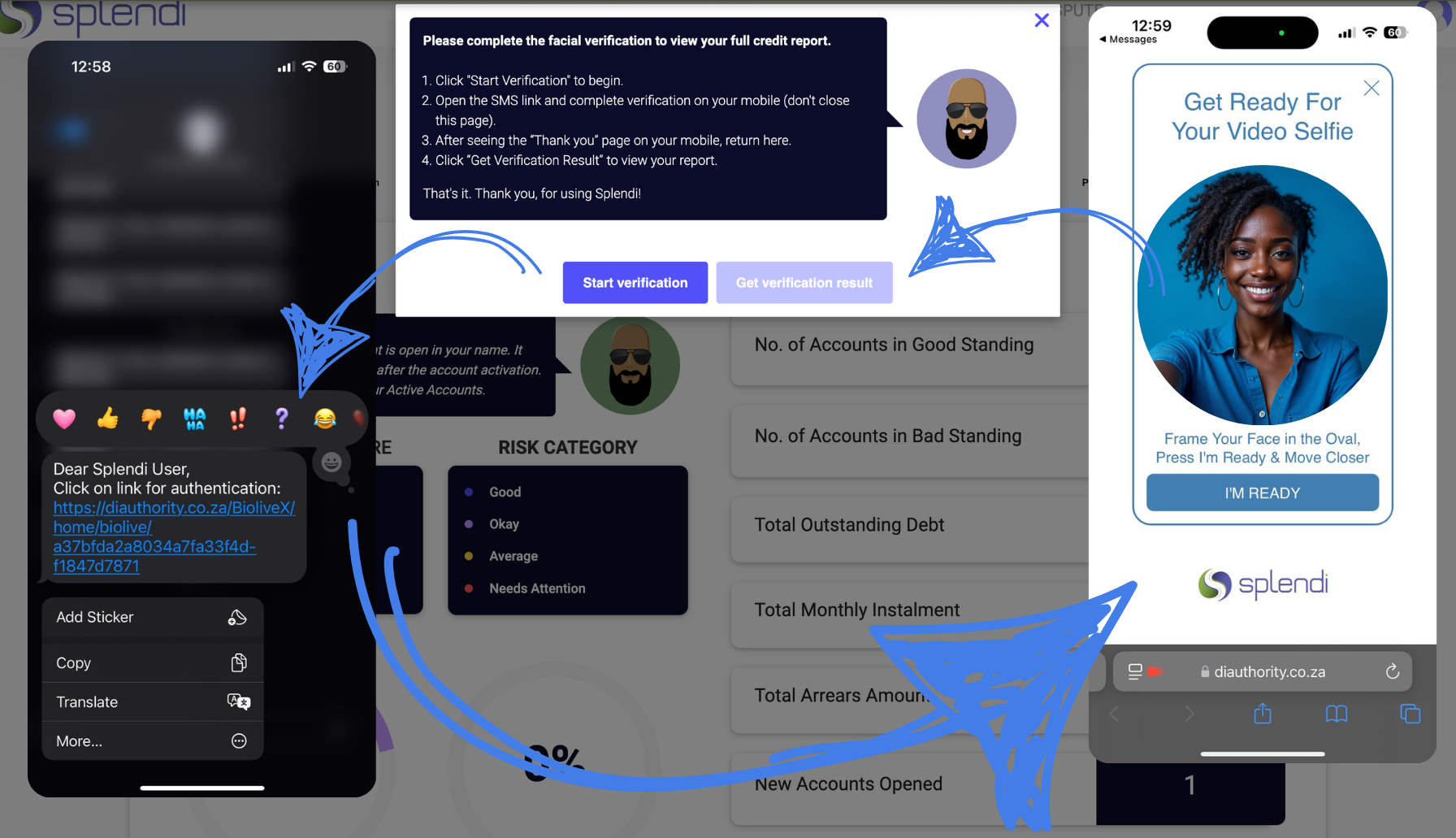

Step 5: View Your Full Credit Profile

To gain deeper insights into your credit health, navigate to the ‘Credit Profile’ tab.

- You’ll receive a Self-verification SMS prompting you to take a selfie.

- This step helps verify your identity using official records.

What is Self-Verification?

Self-Verification is a secure digital process that confirms your identity by matching your selfie with official records. This ensures a seamless and trusted verification experience.

✅ Tip: Ensure you’re in a well-lit area and follow the selfie instructions carefully.

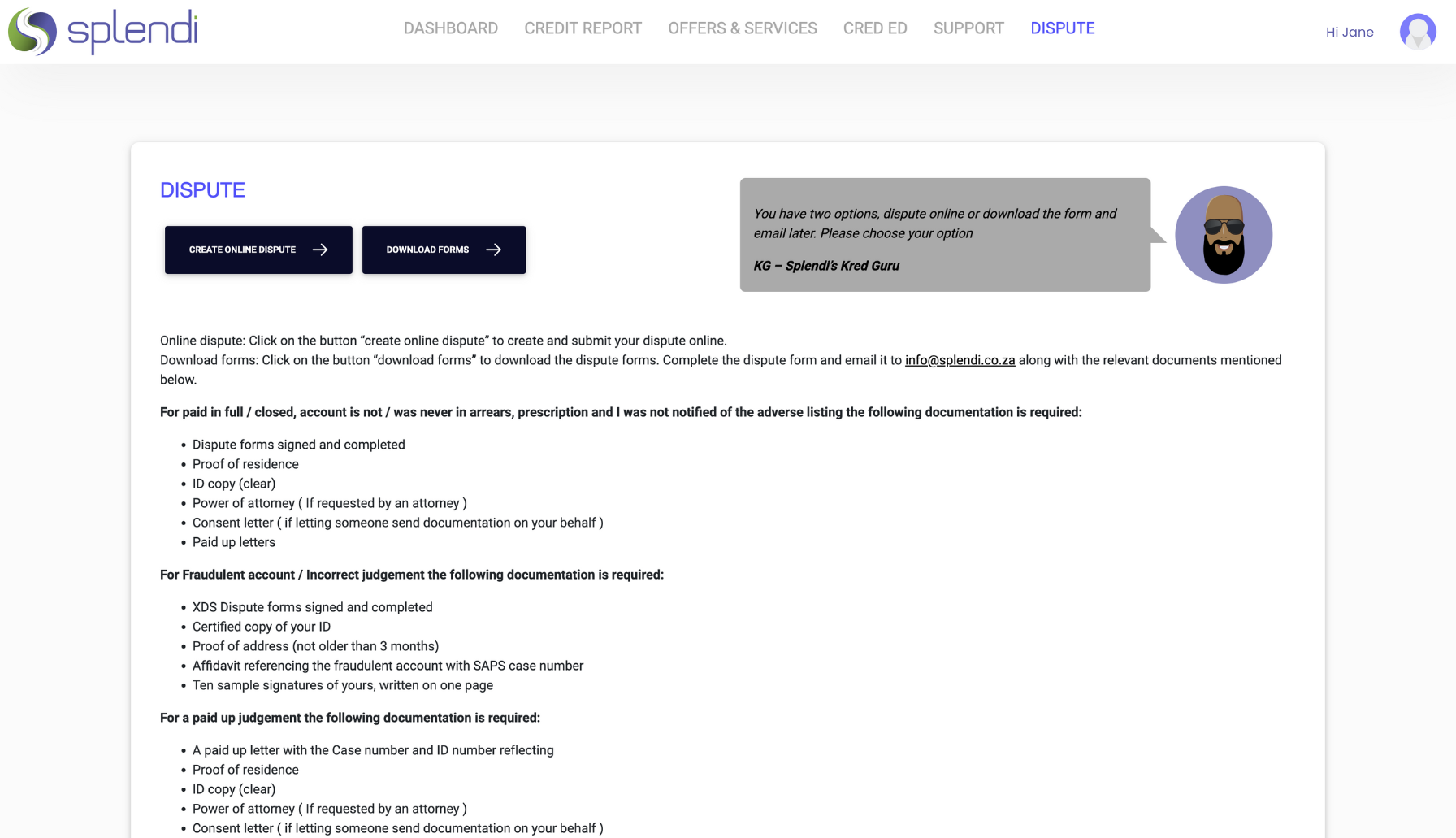

Step 6: Fix Errors and Dispute Discrepancies

To correct any errors or dispute discrepancies, go to the ‘Dispute’ tab.

- Check for any errors or inaccuracies in your report.

- If you find anything incorrect, use the dispute feature to challenge incorrect information.

Fixing errors can improve your credit score and make it easier to access financial opportunities like loans and credit cards.

Explore more on Splendi

With Splendi, understanding and improving your credit has never been easier. Whether you want to fix errors, improve your score, or simply stay informed about your financial health, we’ve got you covered.

- Check out our available offers & services.

- Download your PDF credit report for just R20.

- Learn valuable financial skills with Cred-Ed, our financial education platform.

Sign up today at www.splendi.co.za and start your journey to financial success!